More than $300 billion investment banking giant, JPMorgan is bullish on Bitcoin and called the long term upside potential of Bitcoin reported on 25 October 2020.

It is expected that this positivity usually comes after the world’s largest online payment company Paypal announced to support the buy, sell and hold the Bitcoin and other cryptocurrencies in their wallet.

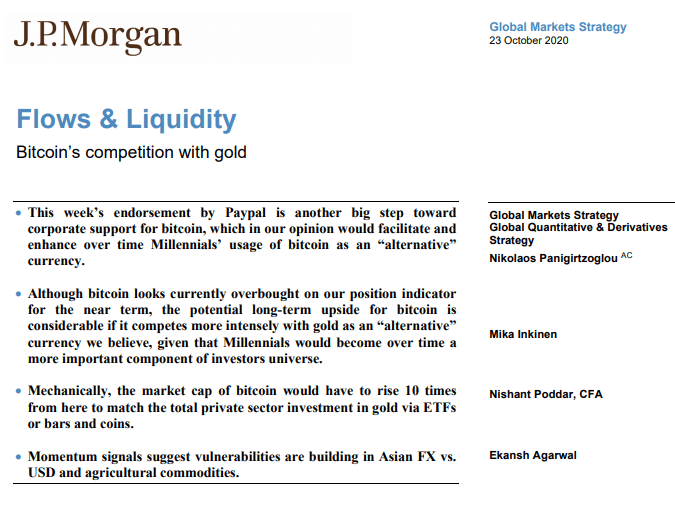

JP Morgan, from “Bitcoin is a fraud and will blow up” in 2017 to “Bitcoin’s competition with gold” in 2020.

We’ve come a long way. pic.twitter.com/xceabkHaVJ— Krüger (@krugermacro) October 24, 2020

Basically, JPMorgan’s Global Markets Strategy division is called for Bitcoin’s competition with gold as the main factor.

“The potential long-term upside for bitcoin is considerable if it competes more intensely with gold as an ‘alternative’ currency we believe, given that Millennials would become over time a more important component of investors’ universe.”

– Business Insider News

JPMorgan gave three major reasons in order to show bitcoin long term bullish potential:

- Bitcoin needs to rise at least 10 times from its current price in order to match the private sector’s gold investment market cap.

- Cryptocurrencies usually have high utility.

- BTC seems to be an appeal to millennials in the longer-term perspective.

Bitcoin is a utility that is one of the major advantages of Bitcoin over Gold. On the other hand, Bitcoin is a blockchain network at its core that makes it possible for users to send BTC to one another on a public ledger, more efficiently and more practically with 100% safety. To transfer gold, there needs to be physical delivery, which becomes challenging as well as costs a lot, and also there will be always a security risk.

Recently, World famous USA-based online payment company PayPal Holdings Inc is now doing meetings in order to buy crypto companies like Bitgo inc. after announcing the Bitcoin payment support on their platform or wallets reported on 22 October 2020.