The executive of Coinbase exchange expects that exchange will see less revenue in the first quarter of this year because of a significant downfall in the industry.

Coinbase is a popular crypto exchange, which is standing at second rank in the whole industry by 24 hours trading volume. However, Binance exchange is leading the crypto Industry by standing at first rank but here Coinbase is doing much better for its future because the exchange’ backed company is a publicly listed company of Nasdaq.

A few days ago, Coinbase exchange published its fourth-quarter earnings report and confirmed that the exchange generated a net $2.5 billion revenue in the last quarter.

The majority of the experts predicted that Coinbase will generate 27% increased revenue but the exchange surpassed this number.

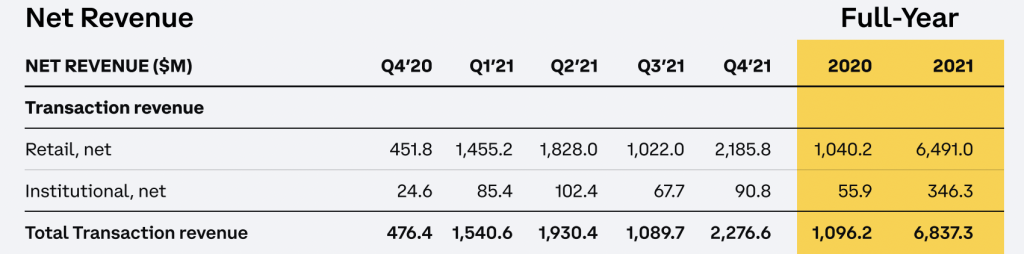

In Q4 Exchange generated a total of $2.276 billion, which is 91% higher than Q3.

Because of this positive news of better growth, the exchange’s native stock price surged by 4.7%.

During the company’s earnings calls, Alesia Haas, Coinbase Chief Financial Officer, noted that the exchange will see a softer trend in the first quarter of 2022 because of a significant downfall in the prices of crypto assets.

Coinbase’ monthly transacting users on average remains 10 million. For this year, Coinbase believes that this number may lie in a bigger range of 5 million to 15 million.

Brian Armstrong, CEO of Coinbase exchange, also stated on this success of Coinbase exchange during the earnings call report and said that we don’t need to see crypto winter because there are many use cases of crypto outside the trading.

“The biggest problem we have is not to think about what’s going to happen in any given quarter, but how do we capture the size and scale of this opportunity in front of us when there are so many multibillion-dollar business opportunities around us.”