Bitcoin is a decentralized cryptocurrency based on Blockchain technology. Before start investing in Bitcoin users should know about how Bitcoin works, once you understand how Bitcoin and Blockchain work then you say that the price keeps rising the upcoming years.

Bitcoin trading will be highly profitable. The market is new and highly volatile as compared to traditional markets (Stock, Forex). Arbitrage and Margin trading is used to make handsome profits.

Bitcoin volatility brings more new users to the crypto space as compared to other cryptocurrencies. Every time the price makes a new high and drops catch the media attention and after the dust settles many new people start investing in Bitcoin.

Start investing in Bitcoin is very easy as compared to the other financial markets. If you already own Bitcoin you are just one click away to start Bitcoin trading. In most cases, no verification is required.

1 Why Trade Bitcoin?

Before we tell you how to start Bitcoin trading you should know the advantages of the Bitcoin market over the traditional markets.

Bitcoin has Global Market

Bitcoin price is not based on a single economy of a country, as happens with fiat currencies. Fiat currency is based on the country development and government decisions (may collapse with a single decision), on the other hand, Bitcoin is traded on the globe and its value is not directly related to any country policies.

However, Bitcoin price is reacted to some major events like China ban cryptocurrency, USA and China trade war, and Venezuela, Argentina inflation rates. Other important factors that play an important part in Bitcoin price are Adoption, Halving, Hashrate, Development (SegWit and Lightning Network).

Bitcoin Market is 24*7 Open

The bitcoin market is not like traditional markets (stock market, Forex market) that have an official exchange and close at a fixed time. Bitcoin has no official exchange but has hundreds of exchanges across the world that works 24*7. Bitcoin has no official exchange, therefore, there is a difference in the price across the different exchanges that will create arbitrage trading opportunities.

Bitcoin is Volatile

Bitcoin is well known for its volatile nature and quick up and downs in a short period of time. Bitcoin daily average volatile for the last 60 days is more than 4 percent and the last 250 days average is 3.56 percent. The volatility catches the eye of a trader and good for quick profits.

2 Find An Exchange to Start Bitcoin Trading

As mentioned above there is no official exchange, however, there are a lot of exchanges running across worldwide. Users should choose a good exchange for privacy, security, and liquidity. Users should consider the following points when deciding to trade on an exchange.

Liquidity

The exchange should have good liquidity and good market depth. Good liquidity on the exchange ensures that your orders get filled and low chance of quick dump of the market.

Trading Fees

The trading fee is an important factor in selecting the exchange. A low fee exchange allows you to take exit even at small price movements that will cover your fee and give you a small profit.

Location

Users should check the location where the exchange is based and check whether the exchange takes deposits in fiat currency from your country. Users should choose a local exchange that is based in the same country that will allow easy deposit and withdraw in the fiat currency.

Regulation & Trust

The exchanges must have regulations license from the regulatory bodies. The exchange must have legal documents to run the platform and the founders and team should have a clear background.

Is the exchange trustworthy? How long the exchange is running and how the exchange performs in bad market conditions? How the exchange reacted on critical situations (Funds lost, Hacks)? All these points should consider before depositing any funds to the exchange wallet.

3 Here are some good cryptocurrency exchanges that fulfill the above conditions.

Binance

Binance is one of the best cryptocurrency exchange available in Bitcoin space now. Binance is the number 1 exchange by daily trading volume. The daily trading volume is more than $3 Billion as per Coinmarketcap data. There is no identity verification needed to trade on Binance if you start a deposit with crypto only.

Binance is providing many features and security options to safeguard user funds. Binance has “Safu Funds” that will be used in case of any hack to recover user loss. Binance has also started margin trading on the platform. Binance also allows users to buy Bitcoin from credit cards in some regions.

Coinbase

Coinbase is also a good exchange to start Bitcoin trading. Coinbase is a USA based exchange and allows users to buy Bitcoin and other top crypto coins like (Ethereum, XRP, Litecoin) directly from banks.

Coinbase has a very good user interface and has high liquidity. Coinbase is regulated cryptocurrency exchange by SEC (Securities and Exchange Commission). Coinbase is not available for all regions like (India, Nepal, North Korea).

Poloniex

Poloniex exchange is also regulated by the US Securities and Exchange Commission (SEC). Poloniex is one of the oldest exchange in the Bitcoin space. There is a high Bitcoin volume.

4 How to Trade Bitcoin on Exchange?

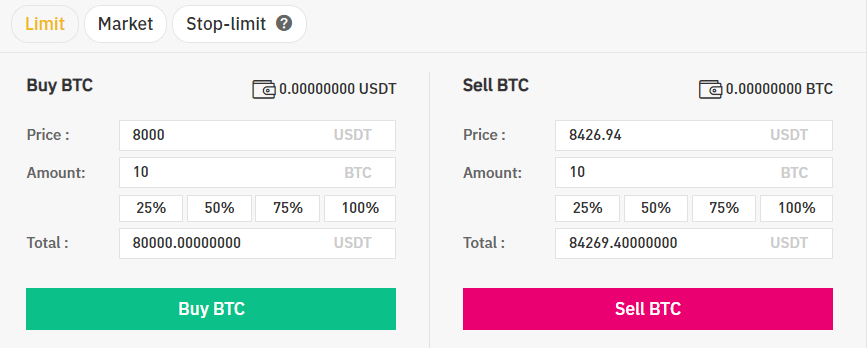

We are using Binance exchange as an example to show how to trade Bitcoin on an exchange. The process is almost the same for all exchanges (there may be some UI difference).

The first step is to create an account on the exchange to start Bitcoin trading.

Click on the register button on the right top corner. Enter E-mail, Password and basic credentials. You need to verify your email to further access the exchange services. Once you have verified the exchange you are good to go.

Go to wallets and deposit Bitcoin to the exchange generated wallet address.

Now you are able to trade Bitcoin with the different trading pairs available on the exchange. Binance allows users to trade Bitcoin with USDT, USDC, USDS, TUSD, and PAX (stablecoins backed by US dollar).

There are many types of trading. You should read about the different types of trading before moving forward so that you can maximize the profits.

Enter the price you want to buy/sell and the amount of Bitcoin. Before hitting the buy/sell button ensure that you have the sufficient funds otherwise gets an error.

5 Important Terms in Bitcoin Trading

Before Starting trading on cryptocurrency exchanges you should know the terms used in trading. You’ll get these terms on all exchanges and in trading discussion forums.

Ask Price: The minimum price where sellers willing to sell their Bitcoin. Users can buy at ask price without any wait.

Bid Price: The minimum price where buyers are willing to buy Bitcoin. A seller can sell at the bid price instantly.

Market Depth: That is the number of Bitcoins that are put for buy/sell and have not purchased. Good buy market depth means there are more buyers than sellers and the price may go upwards.

Arbitrage Trading: Arbitrage trading comes in play when there is a difference in the price on two different exchanges due to some activities. Users can take advantage of the situation and can buy low and sell high to make profits.

Margin Trading: Margin trading is a special type of trading in which the trades are done by borrowed money from an investment brokerage or an exchange. Margin trading is highly profitable but comes with high risks.

6 Risks Involved in Bitcoin Trading

Bitcoin trading has many positive factors like the global market, 24*7 open market and price volatility. There are some risks involved in trading.

Storing Bitcoin on Exchange

In order to trade Bitcoin with USD or other fiat pairs, users need to store their Bitcoin in exchange wallets. Exchanges may be hacked and users lost all their funds stored on exchange wallets.

One of the most famous events in Bitcoin’s History is the Collapse of Mt. Gox, the largest bitcoin exchange in the early days of Bitcoin. Mt.Gox allows users to buy Bitcoin from bank wire transfers.

Bitcoin is designed to control your own money, but many users forgot about it and stored approx 800,000 Bitcoins on Mt. Gox wallets. The exchange CEO claimed that most of the Bitcoin were lost because of some bugs. The funds are not refunded to users yet (some users will be refunded in USD).

A regulated exchange will be used to safeguard funds from the hacking attacks. Poloniex and Coinbase are regulated exchange by SEC and reduce the risks to a greater extent.

Capital Risk in Trading

Always remember that in any type of trading there is a risk of your capital. New traders should start with a small amount or use demo accounts to analysis the market. First learn the market basics (how the market works, where to take an entry/exit).

Trading in Altcoins

Many users lost their Bitcoin in altcoin trading. Altcoins are made to steal your Bitcoin and give you shit tokens in return. Users should avoid altcoin trading in a bear market and only trade the top 20 cryptocurrencies. The best way is to Hodl Bitcoin.

7 Bitcoin Trading Tools

Cryptowatch: Live price charts of all exchange and cryptocurrencies

TradinView: Used for technical analysis and discuss on price movements

Tab Trader App: For API trading on smartphone

Bitcoin Checker App: For price alerts and notifications

BlockFolio/ Delta App: To maintain the portfolio

Also Read

What is Trading? How to Earn Bitcoin From Trading?

What is Bitcoin? All you need to know about Bitcoin

Best Wallet for Bitcoin | Most trusted Bitcoin Wallet

What is Cryptocurrency Mining? Is Bitcoin Mining Profitable?