The majority of financial institutions are showing a significant inclination toward Solana investment products instead of Ethereum ahead of “the merge”, which seeks to make Ethereum a highly efficient crypto network.

Digital Asset Fund Flows Weekly reported that CoinShares says that Ethereum investment products faced significant ignorance over the last 10 weeks of consecutive outflows despite “the merge” development work is going on as a game-changer move for the adoption of Ethereum blockchain.

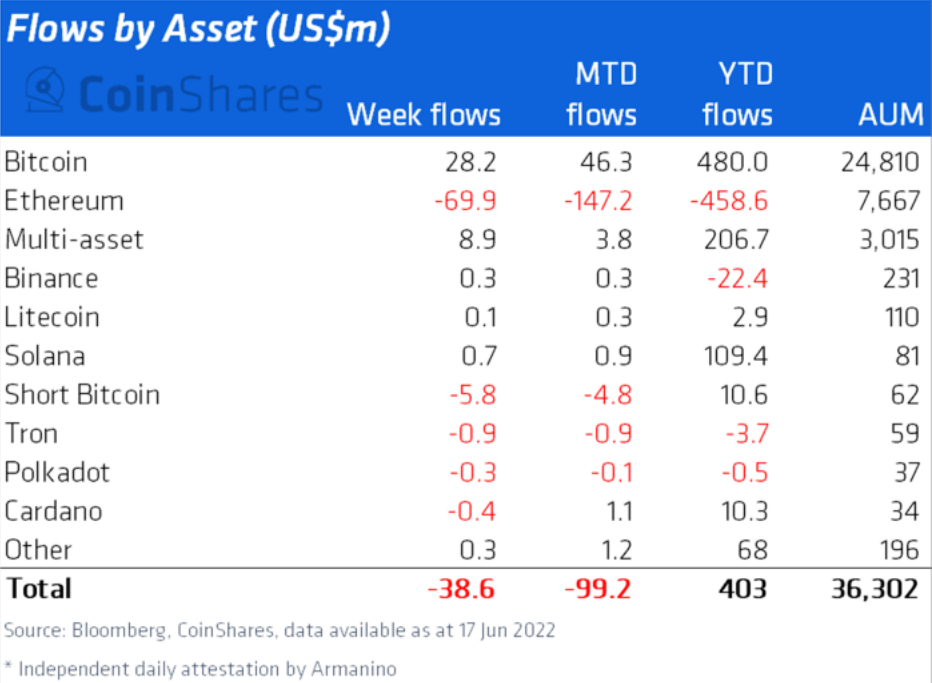

Notably, Ethereum suffered an outflow of around $70 million last week. That outflow of the fund is hinting toward the bearish trend of this crypto market. However “the merge” development plan is more important but panic is grabbing better space in this industry.

Few experts noted that we should not consider this short-term analysis as a total negative point for Ethereum because investments are entering the Ethereum ecosystem traditionally and they are not aware of the real ground-level development work in the Ethereum blockchain much closely.

Reported noted:

“last week having suffered 11 straight weeks of outflows, bringing year-to-date outflows to $459 million. Solana looks to be benefitting from investors’ worries over The Merge (ETH2), with inflows of $0.7 million last week and $109 million year-to-date.”

So under this situation, Solana is getting advantages and it saw a $28 million inflow over the last week.

On the other hand, the biggest market cap asset Bitcoin secured $30 million in the week, which wasn’t enough to save the overall digital asset investment product market. Overall Bitcoin market saw outflows of around $40 million last week. Perhaps Coinshares finds that despite the recent negative sentiment, year-to-date flows remain positive at $403 million.

Binance’s BNB Coin and 18th-ranked Litecoin-backed products also saw significant inflows of funds last week, as well as multi-asset digital investment products, those investing in more than one digital asset.

It was disappointing to see that Tron (TRX), Polkadot (DOT), and Cardano (ADA) all together lost fund Inflow by around $1 million last week.

Read also: Crypto mom says the bear market will help to build a stronger foundation for the crypto industry