Bitcoin price strikes solid at $9,000 but if the upward gaining constantly moves post-halving, BTC could approach the new range record.

The countdown begins, just a few days are remaining for The Bitcoin (BTC) block reward halving and traders have mixed views on the direction of BTC price following the event. Some believe that the “sell the news”, while others indicate that the fall down will occur after the event while some think that the gain will move constantly.

On CoinMarketCap, the top-level asset BTC, if it grows up in price after the halving and cracks its 315-day cycle wherein it saw five continued falter numbers at an expanded rally, a strong upward growth could occur.

Will optimistic momentum continue post-halving?

The forthcoming Bitcoin halving is the only method that appears which influences the manufacture and contribution of BTC. Given that Bitcoin is a reduction currency due to its inflexible supervisory policy, anything that influences its contribution will have an immediate impact on its price.

Traders have come to accept a sell-off following the halving because it is an event that is fixed in the market. A halving appears once every four years and last halvings were tracked in 2012 and 2016.

In past halvings, the price dropped sequentially, improved over the months that followed, and ultimately found new highs 10 to 11 months later.

The big demand is that the nature of the halving indicates the possibility of a shanty in the fallout of its activation. But, if that does that happen, BTC can potentially rally towards the macro range high at $11,500 and $12,400.

A chart shared by a crypto trader called “Galaxy” pictures the expected price trade if it is not true after the halving.

“The fact that BTC is going to $13K simply cannot be ignored,” said the trader while exposing the trademarks of Bitcoin if it purely cracks the $9,500 to $9,900 defense area.

Such a landmark playing out for Bitcoin in the little time period would transform in the commanding cryptocurrency a completely new price cycle and reserving a gloomy beginning to a new multi-year range.

The Bearish Side

The possibility of an expanded Bitcoin reform instantly after the halving without any change still keeps low.

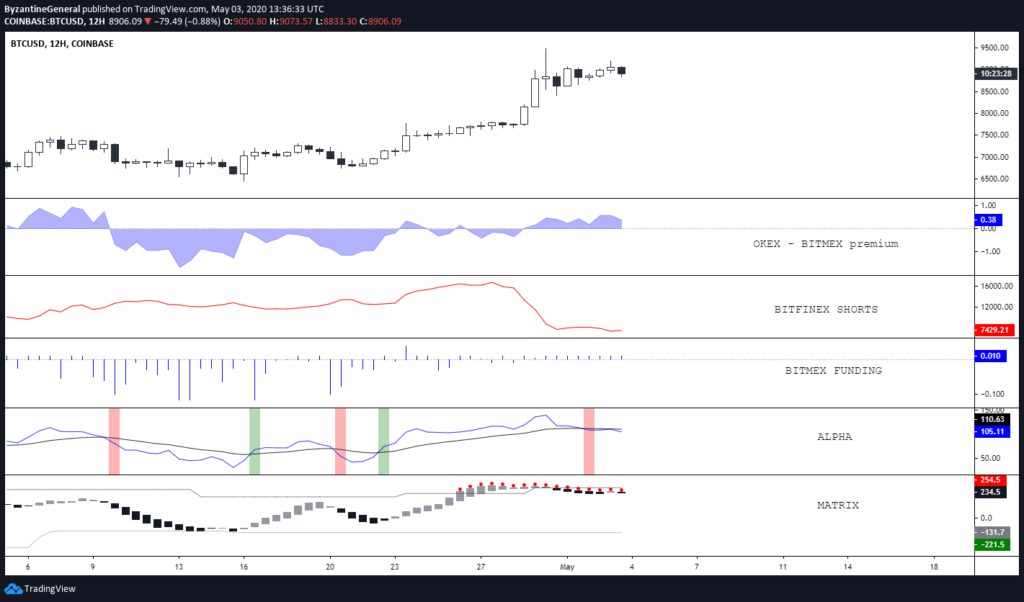

Another crypto trader known as “Byzantine General” stated that virtually every main mechanical sign indicates a reverse action for Bitcoin is due to a 150 % price surge since March.

“Sell signals. Sell signals everywhere. Currently flat, waiting for a good setup,” the trader said.

Other sell indications that may bully the reform of Bitcoin consist of the Relative Strength Index overhead opposite dating back to 2017 and record-breaking sales that appeared in the over-the-counter market when BTC was at $9,400. Both strong the debate for a post-halving drop.

While executing compulsion in the cryptocurrency market overloaded buying demand, there is still a possibility that a post-halving upgrade appears ever, Bitcoin has proved that it can maintain bullish despite blazing sell signs.