What is Bitcoin Margin Trading? How to Start Margin Trading?

1 What is Margin Trading?

Margin trading is a type of trading in which the funds are provided by a third party. Traders actually don’t own the amount they are trading. Traders have access to greater capital as compared to simple trading accounts, allow users to use leverage on the trades.

Margin trading is popular in International Forex (Foreign Exchange) market but also used in stock, commodity and cryptocurrency market.

In Forex and Stock markets the funds are provided by an investment broker. However, in the cryptocurrency market, the funds are provided by other crypto traders who can earn interest on margin leasing. Also, some popular exchanges provide funds to users.

2 How Margin Trading Works?

Whenever a margin traded is initiated the trader need to lock a certain amount of the total order known as margin. The order value and initial investment (Margin) is based on the leverage taken.

For example: If a trader opens a $1,000 order at a leverage of 10:1 then the initial investment (Margin) needed is $100. In Simple words, we can say that the trader has only $100 but because of leverage trading, he can trade with $1,000 and maximize the profits with small investments.

3 What is Leverage?

Different exchanges and market offer different rules for margin and leverage trading. The leverage ratio in the stock market is 2:1, while future contracts can be traded with 15:1 leverage. The range will be higher for the Forex market typically trades with 50:1 and go to 200:1.

The cryptocurrency market offer leverage range from 2:1 to 100:1 and crypto traders denote the leverage ratio in “X” for example 2x, 5x,10x and 100x.

Traders can use margin trading for both long and short positions. A long position means that the price will go up (assumption) and a short position means the price will go down. Traders need to keep in mind that the funds they are trading with are not their (borrowed), so traders can be forced to close the trades in loss (only if the brokerage wants that).

Many cryptocurrency exchanges provide funds for margin trading and users have full control over the trades when to close and when to hold.

4 Bitcoin Margin Trading

Margin trading is always risky and when it comes to cryptocurrency market the risk increases. Bitcoin and cryptocurrency market are highly volatile and that catches the eye of swing/scalp traders.

Bitcoinik team did not recommend Bitcoin margin trading for beginners. Traders need a lot of skills and efforts to analyse the market and open a long/short position. The entry and exit points should be calculated before taking any trade.

5 What is Liquidation?

Liquidation is a very important term when it comes to Bitcoin margin trading.

Let’s assume a trader opens a long position, Liquidation is a stage when the price drops to a threshold limit where all the margin will be used. Users can change the liquidation price by depositing into their account and more contracts to the position, if user unable to reduce the liquidation and the price hits the liquidation price then the position is automatically closed by the exchange.

The trader will lose all the margin (Initial investment without leverage) of the trade. The liquidation price is different for different leverage values, for 2x the liquidation price around 50 percent below the buying price and for 10x the liquidation price is around 10 percent below the buying price.

6 Different Bitcoin Margin Trading Platforms/Exchanges

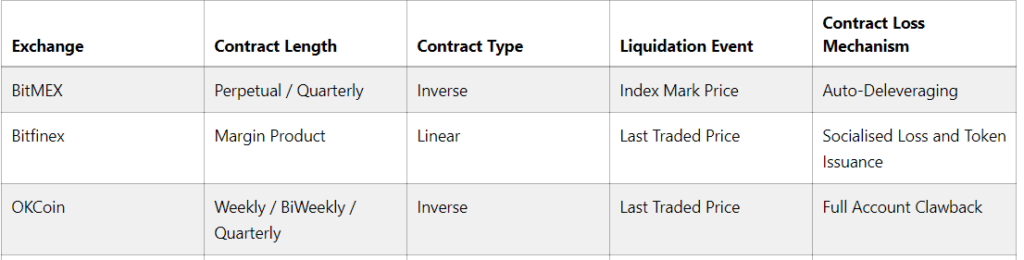

There are many cryptocurrency exchanges that allows users to trade with leverage, few of them are only dedicated to Margin Trading.

Binance the leading cryptocurrency exchange by volume also announced to start margin trading on the platform soon. Bitcoin leverage trading gains a lot of interest after the massive bull run of Dec 2017.

7 Advantage of Bitcoin Margin trading

The main advantage of Bitcoin Margin trading is that the profits are big and quick because of big positions and leverage. A trader can earn a good amount of money with small movement in price. Bitcoin margin trading gives users a chance to test their skills and patience.

8 Disadvantage of Bitcoin Margin Trading

Trading on margin is highly risky and the cryptocurrency market takes the risks to a new level. A small drop in price results in a big loss. The risk increase with the leverage taken, high leverage means more risk. Traders must use stop-loss in each trade to reduce the risk of losing all funds (Liquidation). Stop-loss gives users a second chance to overcome losses.

9 Marging Funding

Users that not want to take high risk into leverage trading can earn from a different way known as margin funding. Some trading platforms and cryptocurrency exchanges allow the feature of margin funding where users can lock their funds to other traders that are using leverage trading.

There are some terms and minimum requirements to earn from margin funding. The requirements may differ from exchange to exchange. The risk to lock the funds for margin funding is low because some time the exchange can manipulate the price to forcibly liquidate positions. The user funds are stored on the exchange wallet so there is a risk of hacking. Users should store their Bitcoin in cold wallets or hardware wallet. Here is the list of best wallet to secure the privacy of a user.

10 Conclusion

Margin trading is a tool to make quick profits in short term. If leverage trading used properly with risk management the portfolio will be increased with goof RoI (Return on Investment).

However, Margin trading is very risky and there is a risk of losing everything in a single trade with a small drop/up in the price. Traders need high skills and risk management techniques. The volatility of the cryptocurrency market increase the risks.