1 What is WorldMarkets?

WorldMarkets is an industry-leading brokerage in the market. World Markets initially started with precious metals (Gold/Silver), Worldmarkets.com has now expanded its business to provide trading services in Forex pairs, stocks, indices, commodities, and Cryptocurrencies.

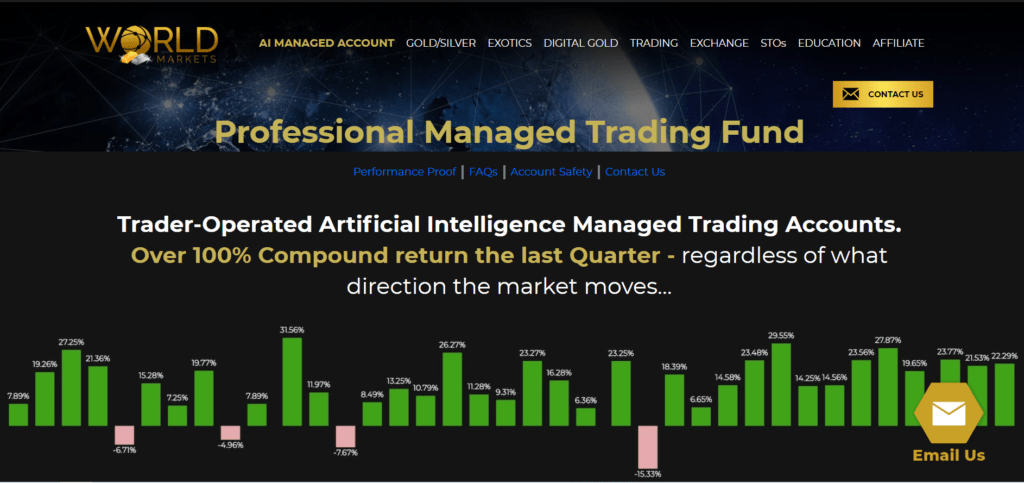

WorldMarkets has more than 50,000 active clients and managing more than 30M assets. The broker uses Trader-Operated Artificial Intelligence Managed Trading system that has an average monthly return of 21.77%

WorldMarkets provide the online products with HYCM, a regulated broker since 1977, and Bitmex, one of the largest cryptocurrency derivatives exchange. The platforms allow traders to connect with the Artificial Intelligence algorithm and trading of Security Tokens the same as top brokers such as UFX.

WorldMarkets has registered offices in Norway, China, Switzerland, Iceland, and other support offices in Bahrain and Panama.

2 Trading Features

The broker provides the latest and popular trading tools for their users to enhance their trading expereience. The different types of trading features include:

Automated Trading Account

This is the most popular and profitable trading tool for the broker. WorldMarkets use an artificial trading algorithm that scans the markets and finds the best trades for their users. The monthly average return of Artificial automated trading is 21.77%.

Security

The security of users’ funds and personal data is always a priority for WorldMarkets. The broker offers 2-factor authentication and military level encryption methods to save the data from hacking attacks. All the funds are stored in cold wallets and well-reputed banks with insurance.

3 Regulations

The regulatory framework of WorldMarkets is unclear, however, the broker is transparent about the risk involved in trading of digital assets and ensures user’s safety measurements. All user funds are stored in Tier-1 liquidity providers and banks to ensure the safety of user funds. WorldMarkets connects with HYCM for trading which is regulated by the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC) and, CIMA.

4 Account Types

WorldMarkets offers different types of trading accounts and users can select any one according to their requirements. The different types of trading account are:

Artificial Intelligence (AI) Managed Trading Account

The AI managed trading accounts allow users to connect with the best algorithms that are used for trading of millions of dollars and can detect the direction of markets accurately. WorldMarkets claims that the AI managed accounts are best for the long term and give very good returns. Users can track the trading style and profits using the MQL trading dashboard.

Self Trading Account (HYCM)

There are some users who want to do trading on their analysis. WorldMarkets offers self-trading accounts through HYCM, on which users can trade independently on their charts and sources.

Cryptocurrency Account (Bitmex)

Cryptocurrency markets get a lot of interest from investors and trades in the past few years. Everyone in the trading and investing field wants to trade cryptocurrency at least once. WorldMarkets offers cryptocurrency trading with the help of Bitmex. Bitmex is the leading cryptocurrency derivatives exchange that offers up to 100x leverage.

5 Payment Methods

The broker takes care of everyone’s choices. Users have a wide range of payment methods for deposits and withdrawals. WorldMarkets accept payments via:

- Wire Transfer

- Visa

- MasterCard

- Bitcoin

- Ethereum

- Skrill

- WebMoney

The broker does not charge any deposit or withdrawal fee, credit card transactions are exceptional. Traders can only make six withdrawals over a period of 12 months. Users can select the account currency and view the balance in EUR, USD, AUD, CAD, SGD, HKD, or BTC.

The minimum deposit depends on the types of the account. The minimum deposit for an artificial intelligence managed account is $2500. The minimum deposit for standard accounts is $100.

6 Fees

The broker states that there is no upfront trading fee associated with any types of accounts including the artificial intelligence managed account, as well as for digital gold or other advanced trading instruments.

The fee structure of the Artificial Intelligence Managed account is:

Standard Accounts are charged a 20% performance fee and a 1% Annual Management Fee.

Gold Premier Accounts ($25,000+) are charged 10% Performance Fee and 1% Annual Management Fee.

All the accounts are subjected to pay the fees on net profit only.

7 Customer Care service

WorldMarkets customer care service is great. Users can contact the customer care team via Email, submit a ticket or direct phone call. The broker provides the customer care service center phone numbers for 43 countries.

The customer care services are available 24 a day from Sunday 21:00 GMT to Friday 21:00 GMT.

8 Advantages of worldMarkets

- Industry Leader in Gold/Silver Trading

- Minimum Deposit starts from as low as $100

- Accept multiple payment methods including Bitcoin and Ethereum

- Offers Artificial Intelligence Managed Trading accounts to maximize the profits

- Have partnership with well known financial firms in the industry including HYCM, BitMex, Barchart, TradingView, DX.Exchange, and many more

- WorldMarkets have won many awards for its trading features and management

9 Disadvantage of WorldMarkets

- The broker only offers a web interface and has application for Android and Apple Smartphones

- The broker does not provide any demo account for understanding the features of the platform

10 Final Thoughts

WorldMarkets have won a numerous award over the year and providing its services to users since 2003. The company provides multiple products including Artificial Intelligence Managed trading accounts, Gold/ Silver trading, cryptocurrency trading this makes it one of most diverse broker in the industry.

WorldMarkets have partnership with the industry leaders including exchanges, trading platforms and data providers that makes it a great choice of users. The broker is always working to make the system better and have a great customer care service.

11 Frequently Asked Question (FAQs)

What fees do you charge?

We charge a 20% performance fee (you keep 80%) and a 1% annual management fee. For Gold Premier Accounts, the fee is discounted to 10% and 0.5% annually.

Are profits compounded?

Yes.

Can I watch my account in real-time?

Yes. You may log-in to your account 24 hours a day to check the balance, Profit/Loss statistics, make deposits and withdrawals or contact the trading team.

Do you have a referral program?

Yes. We offer a 50/50 fee split. Meaning you receive half of our fees. (We do not charge any supplementary fees to your clients – you are compensated from our current fee structure).

For every 10 accounts, you also receive a 1oz Credit Suisse Gold Bar.

If desired, World Markets can also offer an upfront commission on deposits as an alternative. Please note, however, clients must stay with the program for a minimum of 60 days should you choose this option.

Who has access to my trading account?

You maintain full ownership of your trading account at all times. Our trading team has trade-only access to your account. Therefore, no withdrawals/deposits are allowed by any 3rd parties whatsoever. This is of course for account security as well as to abide by AML laws.

What residency restrictions are there for opening an account?

World Markets can accept client accounts from any country except the following: the United States of America, Belgium, Cuba, North Korea, Syria, Iran, Libya, Somalia, Sudan, Myanmar, Yemen, or Russia. Please note this list may change due to global banking policies and sanctions.

Are trading accounts managed by real humans or only AI Technology?

Our trading strategies are powered by true Artificial Intelligence. However, our team still recognized the importance of real human intervention when necessary. For that reason, our trading strategies are all monitored 24×7 by our experienced and sophisticated team of financial analysts and software engineers.

Do I need to watch my account on a daily/regular basis?

No. Our Managed Trading Accounts are fully managed by our team and their technical counterparts. You may log-in to view your account anytime, make withdrawals, deposits, or any necessary profile/documentation updates.

What currency is my account viewable in?

Your account balance may be viewed in EUR, USD, AUD, CAD, SGD, HKD, or BTC.

When can I make withdrawals?

World Markets allows accounts to receive withdrawals monthly, on any date. There are no fees or penalties for making withdrawals from your trading account.