History of candlestick

In the early around 17th century, it was first used by rice traders for understanding the fluctuation of price. A person from the US named Steve Nison used this technique to understand Dow Jones and NYSE after 1850 and published his book “Japanese Candlestick Chart Techniques”. Munehisa Homma was the farmer who developed.

What is Candlestick?

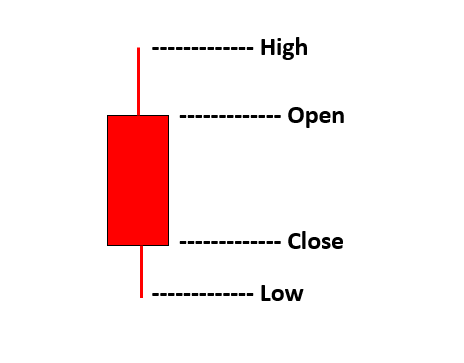

A candlestick is a visual representation of price, specifically to display Open, High, Low, and Close (OHLC). A candlestick has 4 prices I.e., OHLC prices, which is used to form bars/body of the candlestick. A candlestick is also like a bar chart but has a body between open and close price. A candlestick can be green or red depending on opening and closing price or more specifically it can be bullish or bearish.

So, what does bullish and bearish candlestick means?

When the closing price is greater than the opening price then it should be considered as bullish candlestick and when the open price is less than the closing price then it’s a bearish candlestick. The below Image will make you clearly understand.

Candlesticks can be of various types

Let’s have some basic knowledge of candlestick patterns.

What is a Doji?

A Doji is a price reversal candlesticks that have the same opening and closing. This candle signifies indecision in the market between buyers and sellers. This candle mostly forms at the end of the downtrend or uptrend and looks like a plus sign. It has small decent wicks with the same open and closing price or negligible body. There are different types of Doji.

Long Legged Doji :

It’s a candle that looks the same as Doji but has much longer wicks (shadows) than Doji. Mostly appears in a trend indicates strong indecision.

Gravestone Doji :

This Doji indicates that neither buyers nor sellers are active and it’s a bearish reversal candlestick. Between the opening and closing of this candle, buyers pushed the market upside but afterward seller take over the market and closed at the same opening. This type of Doji often found at the uptrend, usually nearby resistance indicating selling pressure.

Dragonfly Doji :

This type of Doji is a bullish reversal candlestick where sellers push the market downside but buyers take over the market and closed at the same opening price. This type of Doji often found at a downtrend, usually at the support level of the market indicating buying pressure.

We will continue to post technical and informative articles for our readers. Keep Learning, Keep Earning 🙂