The Grayscale Bitcoin Trust (GBTC) gives the customers the chance to trade bitcoin in return for a premium on the stock market.

GBTC is not just about the same as compared to Bitcoin. The GBTC is an investment trust or fund that stores Bitcoin on your behalf and secures it. You buy shares of the trust when you buy GBTC.

On the other side, when you purchase Cryptocurrencies, you buy the Bitcoin (BTC) cryptocurrency directly and not share in a Bitcoin investment trust.

Let us dig deeper into what the Grayscale Bitcoin Investment Trust is and its overall aspects now,

What is Grayscale Bitcoin Trust (GBTC)?

GBTC is a platform intended which allows conventional investors to be introduced to bitcoin, where BTC can be bought by individuals from their retirement and stock trading accounts. Grayscale Bitcoin Trust is a financial vehicle that allows investors to swap trust securities containing broad Bitcoin pools.

In certain aspects, the GBTC is similar to a conventional asset; you can only trade it on weekdays, and only selected investors can trade it. The shares in the fund follow Bitcoin’s price. Several other exchange-traded assets are also provided by Grayscale, including Ethereum, Bitcoin Cash and Litecoin, etc.

Background

Grayscale Bitcoin Trust was first founded in 2013 by Barry Silbert, who is also the founder and CEO of the Digital Currency Group (DCG), a bitcoin and blockchain investment firm that has invested in lots of famous companies such as Ripple, Coinbase, Coindesk, Circle, Kraken, and Chainalysis.

Grayscale Bitcoin Trust is funded by Grayscale Investments, LLC (Grayscale) which is regarded as one of the world’s biggest digital currency asset managers. GBTC is an investment fund in Bitcoin that is held solely in the standard cryptocurrency. Via GBTC, you can purchase, retain, and sell Bitcoin shares in a similar way to stocks, without worrying about the complicated operations that might come with owning the individual asset.

How does the Grayscale Bitcoin Trust Work?

A private pool of wealthy investors is welcomed by Grayscale to contribute cash to the fund, which it uses to acquire large quantities of Bitcoin. The fund is then released by Grayscale on public stock markets to ensure that anyone can sell shares in it. The shares of the fund would trade at the actual Bitcoin price at either a premium or a discount.

Bitcoin Investment Trust partners with Xapo, a wallet service for cryptocurrencies. Xapo stores all the bitcoins of the Grayscale Bitcoin Trust in cold storage safe, disconnected, and on an actual physical device, essentially stopping any unauthorized Internet access.

When GBTC carries on these new obligations, they charge a 2 % monthly maintenance fee to their customers, which is very costly relative to most trusts for other cryptocurrencies. Bitcoin still has a fair share of payments, even though the rates paid are a little expensive. The fees paid for bitcoin trading will easily surpass the 2 % charged to the trust, depending on the exchange.

Bitcoin Trust (BTC), Bitcoin Cash Trust (BCH), Ethereum Trust (ETH), Ethereum Classic Trust (ETC), Horizen Trust (ZEN), Litecoin Trust (LTC), Stellar Lumens Trust (XLM), XRP Trust (XRP), Zcash Trust (ZEC), and Grayscale Digital High Cap Fund are the 10 cryptocurrency investment items currently provided by Grayscale.

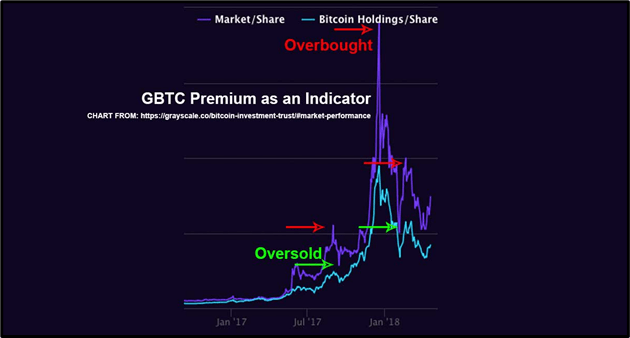

What is the GBTC Premium?

The GBTC premium is referred to as the percentage above of the bitcoin spot price traded by the Grayscale Bitcoin Investment Trust (GBTC). The GBTC premium can be seen as an indicator that tends to differentiate the tops/bottoms in the business cycles on the market.

Since the GBTC premium varies depending on supply and demand, it is important to plan for how the returns will be impacted. You might be able to make money by selling later as the premium increases if you purchase GBTC during record low premiums over spot. Conversely, when you buy GBTC when the premium is high, if you sell when the premium is lower, you could lose money.

Why Does GBTC Trade at a Premium?

Owing to the many risks involved with cryptocurrency, especially ownership, the GBTC holds a premium over buying bitcoin outright. This is because buyers do not have to think about BTC storage when acquiring GBTC shares, it is a more comfortable way to get exposure to bitcoin’s price fluctuations.

1 share in the trust is equivalent to 0.00096312 BTC.

The GBTC premium (%) can then be calculated by using the following formula:

GBTC premium (%) =((implied GBTC BTC-USD rate – Bitcoin price)/Bitcoin price)*100

Where the implied GBTC BTC-USD rate is:

= price of GBTC*(1/0.00096312)

= price of GBTC*1,038.29221696

Is GBTC a Good Buy?

With assured protection, GBTC allows one to buy and keep Bitcoin in a simplified manner. You need to know where to purchase and sell a cryptocurrency to really own Bitcoin. To safely store Bitcoin, you need to maintain crypto wallets, a crypto account, and a private key.

Bitcoin would be lost if you forget private key credentials, even if the key is leaked to others or stolen.

GBTC Vs Buying Bitcoin

There are three major differences between GBTC and buying Bitcoin which can be briefly described as follows:

1) Grayscale charges a 2 % annual fee for GBTC possession. It is a fee to keep Bitcoin.

2) Inside the conventional financial system, Grayscale is nested. You lose access to your GBTC if it goes down, is taken down, knowledge issues, etc. Constant uptime is preserved by Bitcoin.

3) GBTC trades above the spot price (current price) of BTC at a premium.

Advantages of GBTC

With GBTC, you don’t have to think about your issues related to purchasing, storing, and safeguarding your BTC. In the form of protection, you can obtain exposure to BTC, equivalent to purchasing a stock.

In addition to owning Bitcoin directly, you don’t need to think about having to fill out the tax return. Investors enjoy tax incentives of GBTC when shares will be kept in the creditor funds.

Disadvantages of GBTC

As it is the only bitcoin stock on the market, there is a reasonable risk that the GBTC price will decline as soon as there is an alternative. In comparison, another drawback to purchasing bonds instead of buying real BTC is that the cryptocurrency stays open 24/7 while the stock market shuts on weekends.

It is important to remember that these are not real common stocks when considering acquiring Grayscale Bitcoin Trust shares. Shares in a company or corporation are supposed to be securities. GBTC shares are part of an open-ended grantee trust.

Conclusion

Cryptocurrency trading is non-stop, and it can take a lot of time for an individual to gain practice over it. You must research the market closely and do your due diligence before investing any sum of capital.

In general, When it comes to investments, the way to mitigate the risks is to create a large information base.