Amid the increasing hurdles in the crypto sector, JPMorgan stepped back from its crypto relationship with the Gemini crypto exchange.

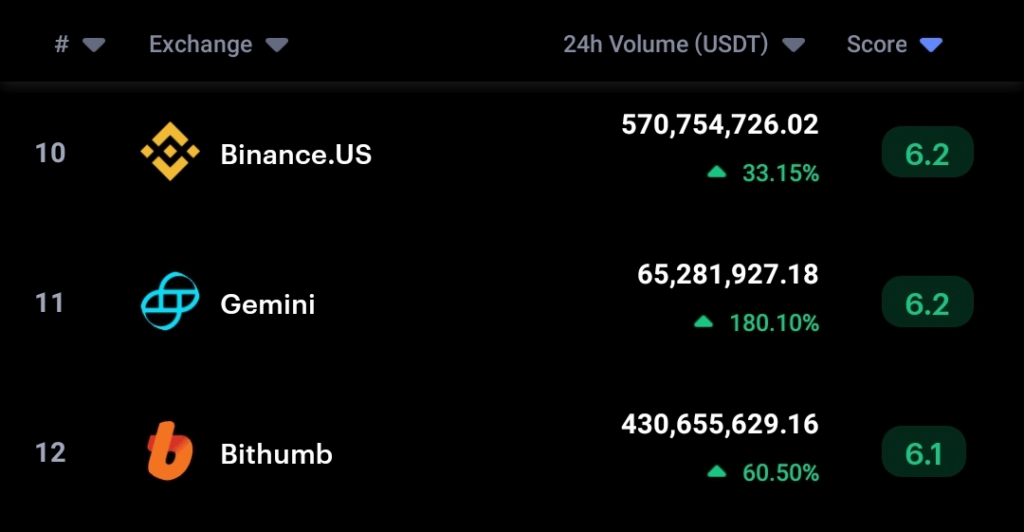

Gemini is a popular crypto exchange, founded by Cameron and Tyler Winklevoss in 2021. By 24 hours trade volumes on this platform, Gemini stands at 11th rank in the Crypto sector.

In Q1 2020, JPMorgan came into collaboration with Nasdaq-listed crypto exchanges Coinbase & Gemini exchange.

On 9 March 2023, JPMorgan, a giant banking institution, reportedly decided to terminate its business relationship with the Gemini crypto exchange.

Reportedly JPMorgan is facing some kind of regulatory pressure, as already the majority of the crypto banking partners faced problems with the US authorities but here it will be early to comment on this matter because neither Gemini nor JPMorgan talked about the main reason behind this latest decision.

Here Gemini will not face a very big problem because there are already some other banking partners including State Street.

Silvergate Gate

Recently Silvergate Bank reported that the company faced huge losses in 2022 because many of its partnered companies face significant losses. The whole news acted as a catalyst for the downfall of stock price of Silvergate capital corporation.

Just a day ago, Silvergate company confirmed that it will liquidate its Bank business & further will use the collected funds to compensate Bank investors & customers.

After the downfall of several crypto companies in 2022, the US authorities are under a very big hurdle and facing pressure to take action against the crypto companies strictly.

These things are clearly showing that the next couple of years will bring new policies in the crypto sector, where Crypto companies will be forced to operate their business under a high compliance environment and also crypto investors will feel confident to invest in crypto assets & use centralized crypto services.

Read also: SWIFT enters the second phase CBDC test, includes trade settlements