This is a complete guide on support and resistance. A trader must know about the support and resistance of the market to make good trades.

Topics we cover in this guide:

- What are Support and Resistance

- How to find Support and Resistance

- What to do when a support/resistance break?

- Fake breakout/breakdown

- Where to put stop loss?

The concepts of trading level support and resistance are undoubtedly two of the most highly discussed attributes of technical analysis. Part of analyzing chart patterns, these terms are used by traders to refer to price levels on charts that tend to act as barriers, preventing the price of an asset from getting pushed in a certain direction.

Support and Resistance is one of the most used techniques in technical analysis based on a concept that’s easy to understand but difficult to master. It identifies price levels where historically the price reacted either by reversing or at least by slowing down and prior price behavior at these levels can leave clues for future price behavior.

There are many different ways to identify these levels and to apply them in trading. Support and Resistance levels can be identifiable turning points, areas of congestion, or psychological levels (round numbers that traders attach significance to). The higher the timeframe, the more relevant the levels become.

Support and Resistance

Support is a price level where a downtrend can be expected to pause due to a concentration of demand or buying interest. As the price of assets or securities drops, demand for the shares increases, thus forming the support line.

On the other hand, resistance is a price level where an uptrend can be expected to pause to break the selling of the assets. As the price of the asset increase, more trader starts booking profits and results in a drop in the price.

Horizontal Support Line

A horizontal support line is a line from which the price of asset rebounds. In the below chart it is clear that the Bitcoin price is touching the horizontal support line of $6000 and moving upwards.

Note: Support becomes weaker after every test. The more time it is tested the weaker it becomes.

Horizontal Resistance Line

A horizontal resistance line is opposite of the horizontal support line. The price of the assets drops after touching the horizontal resistance line.

Note: Resistance becomes weaker after every test. The more time it is tested the weaker it becomes.

How to draw a Support line?

The support points can be easily identified by looking at the chart. Support is where the price bounce back, look for those points where the price bounced back many times, and draw a line connecting the support points. You will get a horizontal support line. See the chart example below:

To draw a valid support line, you need at least two points on the chart.

How to draw a Resistance Line?

Resistance is a point where the price of the asset rejected many times. The market tests the resistance and traders start booking profits that result in a drop in the price. You need at least two points to draw a valid resistance line.

Breakout

When the price breaks the resistance line and trade above the line is called a breakout. The market turns bullish after a valid breakout and traders start buying/opening a long position in the asset.

The more times a resistance point gets tested, the weaker it becomes. The majority of traders are waiting for a breakout of the resistance line to open long positions. A valid breakout will give good profits in the coming hour/days/weeks depends on the timeframe you are using to trade.

Always wait for the confirmation of the breakout. Don’t open a trade instantly because the breakout may be a fakeout. We will discuss the fakeout below in this post.

Breakdown

When a support line is broken downwards it is called a breakdown. The market turns bearish after a breakdown. It’s a better idea to close all the long positions when a breakdown confirmed. Many traders open short positions after the breakdown and make good returns on their trades.

This is a very good example of a breakdown. Bitcoin is respecting the support of $6000 in 2018 and the breakdown happens in November 2018. The price of bitcoin falls to $3000 from $6000. Traders waiting for a breakdown will make a lot of money in this drop by opening short positions.

Always wait for the confirmation of the breakdown. Don’t open a trade instantly because the breakdown may be a fake breakdown. We will discuss the fake breakdown below in this post.

Fake Breakout

Fake breakout or fakeout is a condition when the price breaks the resistance line and instantly comes below the resistance line in the next candle. No candle close above the resistance zone to call it a valid breakout. See the below example and you understand better.

In the above chart, the BTC price shows 2 fakeouts at different levels. The price breaks the resistance line and comes back under the resistance line with a huge red candle. Traders those open along just after the resistance line fakeout will be in huge loss or rekt. Always wait for the confirmation before opening any trade.

Fake Breakdown

The fake breakdown is a condition when the price breaks the support line and instantly comes above the support line. No new candle close below the support line to call it a valid breakdown. See the chart for a better understanding.

In the above chart, the BTC price dumps below the support line, and instantly the next candle with a huge pump gets back above the support line. Those traders opened the short trades instantly after the support is broken are in huge loss because it is a fake breakdown, not a valid breakdown. Always wait for the next candle for confirmation of the breakout/breakdown and then open the trades.

Where to Put Stop Loss?

Stop-loss is a must thing for every trade. The cryptocurrency market is highly volatile and sometimes the market plays against your analysis or expectations. Stop loss will help to minimize the loss and open room for better opportunities.

Always open the trades after trend confirmation. If you are in doubt then leave it and wait for the next setup. Not every day is a winning day. The stop loss must be placed below/above 7-9% of the trade. This is for normal trading (spot trading), adjust your stop loss according to the leverage used (if you are doing margin/futures trading).

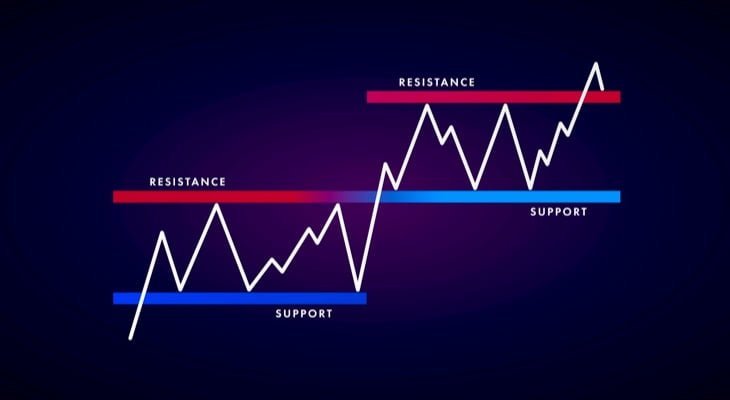

Previous Resistance Become Support

The previous resistance line work as a support zone for the market. Below is a perfect example of this. Bitcoin is respecting the previous resistance line as support. The same can be true for a support line. The previous support line will work as resistance when the market starts moving upwards.

Thanks for your time. That’s all for today. Hopefully, you learn something today. Always remember trading is not a one-day game, it requires time and patience to master. If you are in doubt try your setup on demo accounts or use very small funds for trading for learning purposes. We will continue to bring such educational stuff for you, share it with your friends and family and earn together.