What is Moving Averages (MA)?

Moving Average (MA) is a very simple and famous indicator used by the majority of the traders in their Technical Analysis. MA (Moving Average) uses the previous price data and average/ smooth out the price, an average is calculated over a specific period of time. Some traders use MA (Moving Average) to find trend direction and some for entry and exits because it cuts the noise from the market and smoothes out the price to understand the trend. There are various types of Moving Average:

Simple Moving Average (SMA)

SMA stands for the Simple Moving Average known as Moving Average in general which just calculates an average of the price over the given period.

Calculation

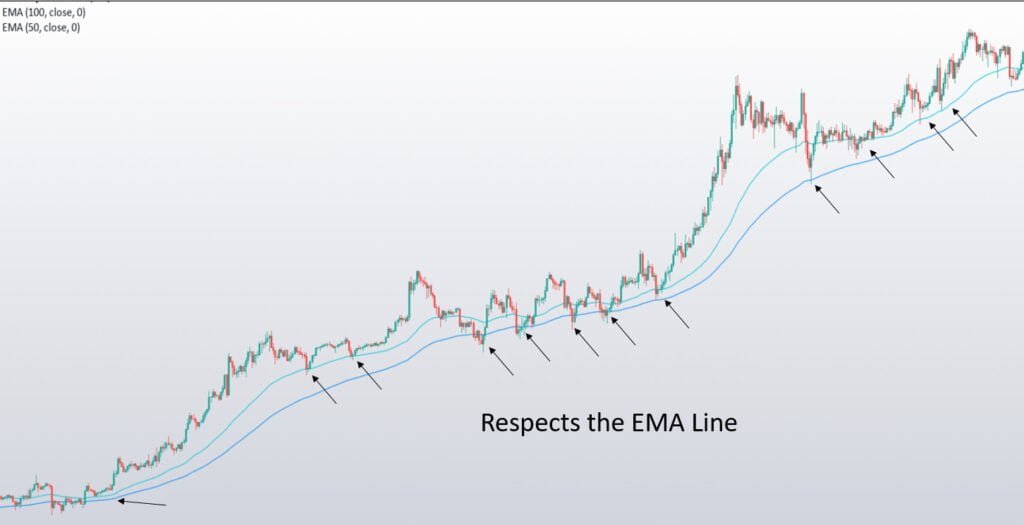

You can use SMA (Simple Moving Average) to find trends. Most use any combination of moving average, which suits you. Most traders use 50 or 100 or 200-period moving average on 4H and 1D TF (Time Frame) for trend direction. Few traders use Moving Average crossovers to enter and exit the trade and price often bounces from MA (Moving Average) line.

As you see it’s an uptrend and knowing the bigger TF (Time Frame) trend and entry/exits in smaller TF will have some good traders. Often traders use to catch swings using things. Also, if you missed any trade then you can enter while the price is bouncing/ respecting with an MA (Moving Average).

Exponential Moving Average (EMA)

Exponential Moving Average (EMA) is widely used by the trader and better than SMA (Simple Moving Average) because it gives more weightage to recent price by using the most recent data of price. The calculation is a little bit different in it.

Calculation

EMA (Exponential Moving Average) is giving much more entries than SMA (Simple Moving Average), if we the trend direction we can catch much more swings. You can use crossover too.

Smoothed Moving Average (SMMA)

Smoothed Moving Average is just an addition of EMA (Exponential Moving Average) and SMA (Simple Moving Average). It gives equal weightage to the current price as the previous prices and takes all available price data into account.

Calculation

You can also use a combination of SMMA, EMA, and SMA to build a perfect strategy. Although Moving Average is a lagging Indicator is based on the last price, but we can use it as potential entries.

There are many more Moving Averages but not widely used, i.e., LWMA (Linearly Weighted Moving Average), VWMA (Volume-weighted Moving Average), HMA (Hull Moving Average), VMA (Variable Moving Average), etc.

Golden Crossover

When a short period MA (Moving Average, can be SMA or EMA) breaks above, then a longer period Moving Average is known as Golden Crossover. Traders usually see it as a long-term uptrend. Moving Average can be 50, 100 or 100, 200 or 50, 200.

Death Crossover

It’s just the opposite of Golden Crossover, it gives an indication of a potential long-term downtrend. Values are the same as Golden crossover has. False crossover may come because the indicator is lagging.

Note: Always Trade indicators wisely with proper risk management else your trading funds will always at high risk.