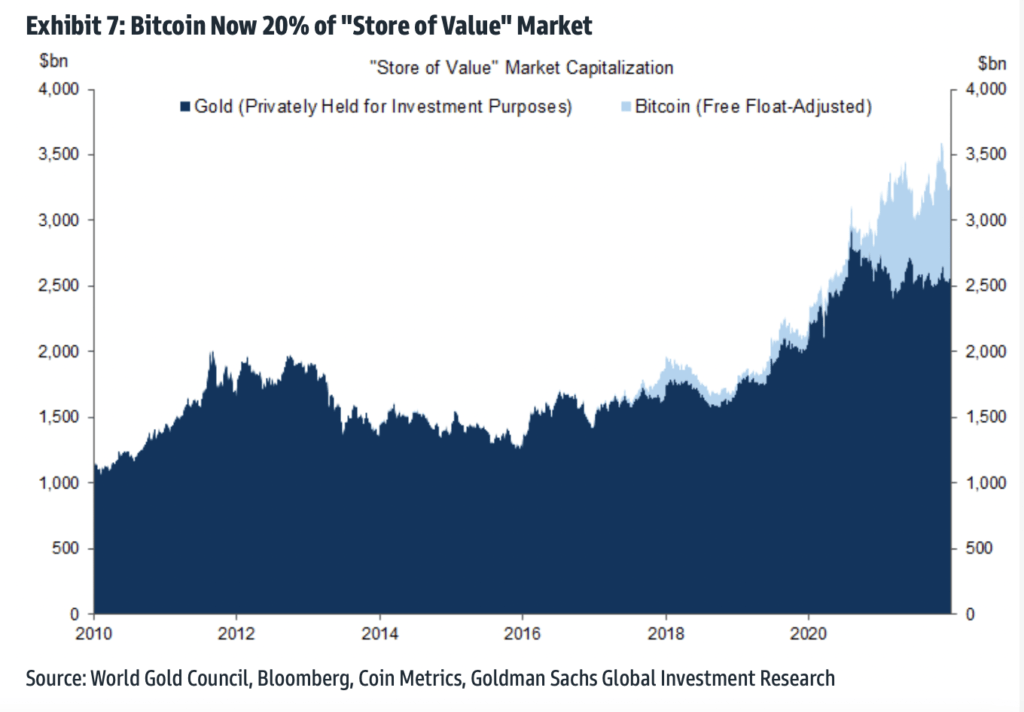

Investment banking giant Goldman Sachs’s research hinted that Bitcoin steals the market share of the gold.

Goldman Sachs Inc. is a global investment banking, securities, and investment management firm that provides many types of financial services to substantial and diversified client base that includes financial government and non-government organizations and individuals also. So we can understand very well how much this firm is expert in its analysis with the current situation of experience to handle financial assets and services.

On 4 January, Through a note, Goldman Sachs stated to its clients that adoption of the biggest crypto asset ( Bitcoin) is increasing and it may cost the market share of the gold.

“a byproduct of broader adoption of digital assets, and possibly due to Bitcoin-specific scaling solutions.”, Note added

According to the available data, right now Bitcoin is covering around 20% of the market, which is using bitcoin as a store of values. And this market share of Bitcoin in the store of value market is dominant over Gold.

Goldman Sachs has its prediction on the price of Bitcoin. According to this firm, if Bitcoin will continuously grab its dominant position in the best store of value market by 50%, then no one can stop Bitcoin to hit $100,000. Besides this, the investment banking giant also claimed that the new use case of Bitcoin may act as another catalyst for Bitcoin.

“Bitcoin may have applications beyond simply a “store of value”—and digital asset markets are much bigger than Bitcoin—but we think that comparing its market capitalization to gold can help put parameters on plausible outcomes for Bitcoin returns,”

Bank noted

These statements by the financial services giant firms showed that Bitcoin is not going to stop and there are chances that Bitcoin may replace the payment system if better use cases with very high efficiency will enter like Bitcoin lightning based projects, without limitation just like Layer1 features.

Read also: CardanoCube listed ADALend dApp, something new?